How COVID-19 Calls for a Digital Transformation in Insurance

BUSINESS INSURANCE

Apr 21, 2020

The outbreak of COVID-19 and the necessity of physical distancing has changed the landscape of how many industries conduct business. As more and more businesses are required to work from home, we have had to turn to digital tools to stay connected to our teams and continue servicing clients. Our Foxquilt Senior Account Executive, Kassa, wrote an article calling for an insurance digital transformation in the industry and encouraging brokers to turn to digitization to better service their clients - especially during these unprecedented times. Learn why a digital transformation in the insurance industry is more necessary than ever:

As the Canadian marketplace starts to feel the impact of COVID-19, the reality of "Social Distancing" is starting to set in. Society has begun to adhere to this new "norm", implementing this strategy as the only effective option to flatten the curve while attempting to avoid its' potential to cause a global economic catastrophe.

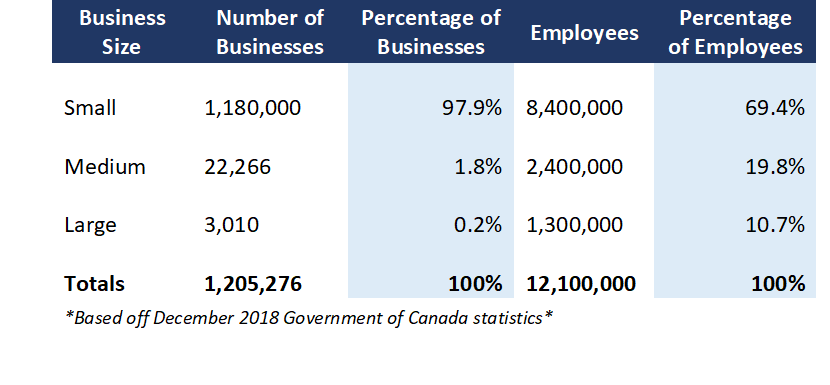

Regardless of the size of the business, COVID-19 has plunged most organizations into complete uncertainty, forcing their owners to make very tough business decisions. In many cases, operations have been significantly altered or shut down, resulting in large layoffs. Business owners must feel overwhelmed as they worry about the financial viability of their companies as well as the health and safety of the communities they serve. The last concern that should be crossing their minds' is what is going on with my commercial insurance. It's at times like these that insurance brokers should be stepping up, proactively reaching out to clients to support them in any way they can; after all that's why they chose a broker and not another channel for insurance.

I've received several calls from business owners who haven't been to able to reach their brokers on the phone or get a response to emails. Others have been told by their brokers that they need time to setup to work from home. Although insurance brokers aren't immune to the COVID-19 crises, we do have a responsibility to be prepared to support our clients in a timely manner. I would also encourage brokers to be as helpful as possible and answer any questions you can, even if they aren't coming from your current clients.

It has been essential for brokerages to be able to conduct business 100% digitally for some time now. Brokerages and insurers that have made the necessary investments have been able to support their clients seamlessly. Many have just started to consider strategies around going digital, according to Applied Systems' 2019 Digital Technology Adoption Benchmarks and Trends report, the average rate of digital adoption at an independent brokerage is 43%, down 1% from 2018's report. Brokerages that have fought change and delayed such investments are now under serving business owners and there isn't any excuse for that - it's times like these that give brokerages the opportunity to exemplify the value proposition of our channel and serve the entire Canadian business community to the best of our ability.

As Kassa points out, an insurance digital transformation and a shift to conducting business digitally is necessary to maintaining service for clients, to make sure they are not left in the dark about their insurance coverage during these difficult times. But there is an also necessity for the insurance industry and for brokers to come together and help support communities like small business owners. We can help provide knowledge and education during a time where information seems limited or confusing. If there are ways our Foxquilt team can help support business communities in need, if you have any questions about your coverage, if you would like us to promote your small business, feel free to share in the comments or by contacting us. We're happy to share our platform to help out right now.

Need business insurance? Get your quote today

BUSINESS INSURANCE

What Contractors Need from a General Liability Policy

Not all contractor work is the same. A GL policy should reflect the actual operations of the business, whether that’s carpentry, electrical work, painting, or another trade.

BUSINESS INSURANCE

Industry Hiring Trends for Skilled Labor Trades in 2024

We teamed up withBlue Recruit to give you a competitive edge on what are the U.S. hiring and labor trends for skilled trades and contractors in 2024.

BUSINESS INSURANCE

How Do I Upload My Proof of Insurance (COI) to Amazon?

Congrats on getting your Amazon seller insurance coverage! One last step: Uploading it to Amazon. Here’s a step-by-step guide on how to do it.